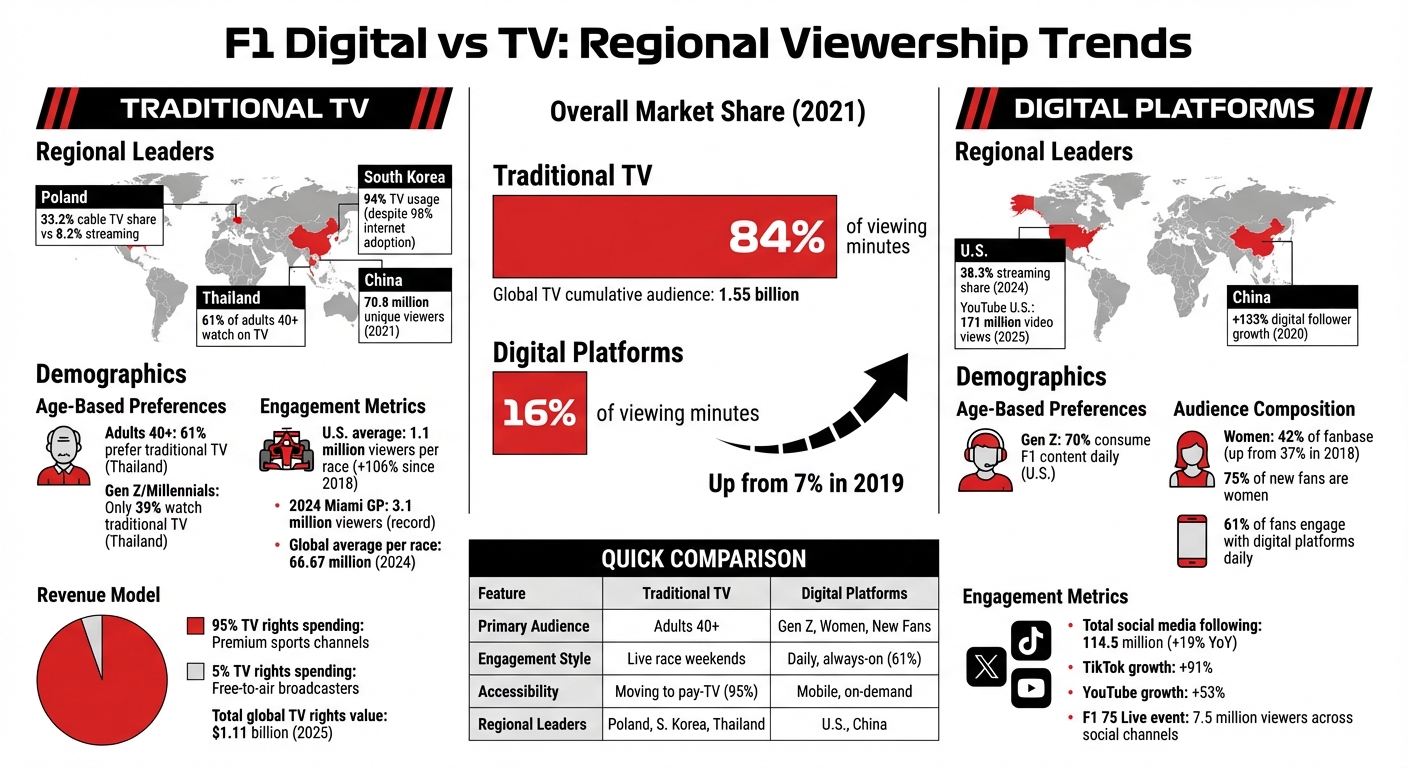

F1 Digital vs TV: Regional Viewership Trends

TV still leads F1 viewing, but streaming is surging—Gen Z and U.S. fans drive digital growth while Poland and South Korea remain TV-first.

Formula 1's audience is shifting from TV to digital platforms, but the change isn't the same everywhere. Here's what you need to know:

- TV Still Dominates Globally: In 2021, 84% of F1 viewing minutes came from TV, with a cumulative audience of 1.55 billion. Regions like Poland and South Korea still rely heavily on TV.

- Digital is Growing Fast: Digital's share rose from 7% in 2019 to 16% in 2021. In the U.S., streaming accounted for 38.3% of total viewing time in 2024, outpacing cable TV.

- Age Matters: Younger fans (Gen Z) prefer streaming and social media, with 70% of U.S. Gen Z fans consuming F1 content daily. Older viewers stick to TV, especially in markets like Thailand, where 61% of those aged 40+ watch on TV.

- Regional Differences: Countries like China lead in digital engagement, while Poland favors cable TV (33.2% share vs. 8.2% for streaming).

Quick Takeaway: F1 balances between TV for live events and digital platforms for daily engagement, driven by younger audiences and regional habits.

F1 Digital vs TV Viewership: Regional Trends and Demographics Comparison

1. Digital Platforms

Regional Viewership Trends

Digital consumption habits differ greatly across various regions. In the United States, YouTube alone recorded 171 million video views in 2025. Meanwhile, in China, platforms like Weibo, WeChat, and Douyin have driven a surge in digital engagement. Digital followers in the region grew by 133% in 2020, reaching 2.7 million by 2021, and local social channels reported a 35% rise in activity by 2025. South Korea presents an interesting mix, with 98% internet adoption paired with 94% TV usage, showing how traditional and digital media coexist. On a global scale, the share of F1 viewing minutes attributed to digital platforms jumped from 7% in 2019 to 16% in 2021. These regional patterns provide insight into how digital consumption evolves alongside local preferences and technological access.

Demographics and Preferences

Younger audiences are leading the charge in F1's digital transformation. Worldwide, 61% of F1 fans engage with digital platforms daily. Women now represent 42% of the fanbase, up from 37% in 2018, and 42% of female fans actively follow the F1 Academy series, showcasing the growing appeal of inclusive narratives. In the U.S., Gen Z fans show a strong "driver-first" focus - 40% prioritize individual driver personalities over teams or the sport itself. This trend aligns with the influencer-driven nature of modern fandom, where drivers like Lewis Hamilton (39.7 million followers), Charles Leclerc (18.9 million), and Max Verstappen (14.6 million) command massive digital audiences. These shifts in demographics are reshaping how F1 tailors its digital content to meet fans' evolving expectations.

Content Accessibility and Engagement

F1's digital footprint continues to grow rapidly. By 2025, the sport's social media following hit 114.5 million, marking a 19% year-over-year increase. Platforms like TikTok (up 91%), YouTube (up 53%), and Facebook (up 51%) saw the most growth, while X (formerly Twitter) experienced a modest 1% rise. YouTube race highlights alone enjoyed a 33% increase in views, offering fans an easy way to catch up on key moments. The F1 75 Live season launch event further highlighted the sport's digital reach, drawing 7.5 million viewers across social channels, with its YouTube stream reaching audiences in 211 territories. Starting in 2026, Apple TV will become F1's exclusive broadcast partner in the U.S., signaling a major shift toward streaming as the primary way fans in this key market experience the sport.

2. Traditional TV Broadcasts

Regional Viewership Trends

Traditional television still plays a significant role in Formula 1 viewership, though the numbers and trends vary widely by region. Even with the rise of digital platforms, TV broadcasts continue to attract large audiences in key markets. For example, in the United States, F1's popularity on traditional TV has skyrocketed. By 2024, the average TV audience per race reached about 1.1 million - an incredible 106% growth since 2018. The 2024 Miami Grand Prix on ABC broke records, drawing in 3.1 million viewers. Meanwhile, China remains unmatched in scale, with 70.8 million unique viewers tuning in during the 2021 season. European countries also saw strong gains in the early 2020s, with increases of 81% in the Netherlands and 48%, 40%, and 39% in France, Italy, and the UK, respectively.

Scheduling plays a critical role in these regional trends. U.S. audiences tend to peak during primetime races in North America, such as those in Miami, Montreal, and Austin. However, viewership drops significantly for early morning races, like those starting at 1:00 a.m. ET. John Suchenski, ESPN's Senior Director of Programming and Acquisitions, highlighted this challenge:

"You're asking viewers who we've trained for several years to show up on Sunday mornings... to come on Saturday mornings, which is just not traditional".

These scheduling nuances are further influenced by the age-based preferences discussed below.

Demographics and Preferences

Demographics heavily shape how audiences consume F1 on traditional TV. Age, in particular, creates clear divides. In Thailand, 61% of adults aged 40 and older watch traditional TV, compared to just 39% of Gen Z and Millennials. Similarly, in South Korea, traditional TV remains dominant, with 94% of the population still tuning in, even though internet adoption has reached 98%. Poland also shows strong loyalty to traditional formats, with cable TV accounting for 33.2% of total viewing time, far outpacing streaming platforms, which hold just 8.2%.

The rise of subscription-based broadcasting has further shifted the demographic landscape. By 2024, only 5% of F1 TV rights spending came from free-to-air broadcasters across 18 major markets, while premium sports channels claimed the remaining 95%. In the U.S., F1 stands out for its appeal to younger and female audiences, outperforming NASCAR and IndyCar in these segments, even though NASCAR averages over 3 million viewers per race.

Content Accessibility and Engagement

The ongoing shift between free-to-air and subscription-based models highlights a trade-off between audience reach and revenue. F1's broadcasting revenues have surged by 91% since 2014, largely driven by subscription services. However, this financial growth has come with a downside - the average global audience per race has steadily declined, dropping from 68.18 million in 2023 to 66.67 million in 2024.

Markets transitioning to pay-TV often see mixed short-term results but show strong potential over time. For instance, Sky Germany reported a 55% year-over-year increase in cumulative audience in 2021 after adopting a more exclusive broadcasting model. By 2025, the total value of global F1 TV rights reached $1.11 billion, with the top five markets - France, Italy, Spain, the UK, and the USA - accounting for $553 million. Despite the drop in average per-race viewership, the most dedicated fans remain loyal, with 86% of them watching 16 or more races per season.

What F1's huge new TV deal means for you

Pros and Cons

When it comes to watching Formula 1, both digital platforms and traditional TV broadcasts have their own strengths and drawbacks, and these often depend on where viewers are located and their personal preferences. Traditional TV has long been the go-to option, offering broad and affordable access, especially for live races. Its reliability during live events is a major plus. However, the rigid programming schedules of TV don’t always fit into today’s fast-paced, mobile lifestyles. Another challenge for traditional TV is the shift from free-to-air broadcasts to subscription-based models. By 2024, a staggering 95% of spending on F1 TV rights went to premium sports channels, leaving only 5% for free-to-air options. This shift has made it harder for some fans to access live races.

On the flip side, digital platforms have embraced flexibility. They offer on-demand access and are compatible with mobile devices, making them especially appealing to younger viewers. Formula 1's President & CEO Stefano Domenicali highlighted this shift, saying:

"The sport is embedded in culture now, via streaming, storytelling, and social media, and that's helping more people connect".

That said, digital platforms still account for a smaller slice of the pie. In 2021, only 16% of all F1 viewing minutes came from digital sources. Nielsen’s research captures this balance perfectly:

"Digital platforms offer precise targeting and interactive capabilities, traditional media like television provides broader reach or credibility with certain demographics".

Regional trends also reveal interesting contrasts. In Poland, for example, cable TV dominates with 33.2% of viewership, while streaming lags behind at 8.2%. In the U.S., it’s the opposite, with digital platforms taking the lead. In Thailand, traditional TV still holds sway among older adults (61% of those aged 40+), but younger generations, including Gen Z and Millennials, are turning away, with only 39% tuning in. Clearly, age and local infrastructure play a big role in shaping these preferences.

Another key difference lies in how audiences engage with the content. Traditional TV focuses on race weekends, offering a more passive viewing experience centered around live events. In contrast, digital platforms create an "always-on" connection, allowing fans to engage with F1 content daily - 61% of highly engaged fans do just that. This constant interaction has made digital media a gateway for attracting new fans. Interestingly, three out of four new F1 fans are women. Still, traditional TV remains the top choice for those who want the full live race experience. In fact, the global TV audience reached 1.6 billion in 2024, even though the average viewers per race dipped slightly from 68.18 million in 2023 to 66.67 million in 2024.

Here’s a quick comparison of how traditional TV and digital platforms stack up:

| Feature | Traditional TV | Digital Platforms |

|---|---|---|

| Accessibility | High for live events; moving to pay-TV models | High mobile/on-demand access; suits flexible lifestyles |

| Engagement | Focused on live race weekends | Always-on; 61% of fans engage daily |

| Regional Strength | Poland (33.2% share), South Korea (94% usage) | U.S. (38.3% share), China (+133% follower growth) |

| Primary Audience | Older adults (40+) | Gen Z, women, and new fans |

| Share of Viewing | 84% of total minutes (as of 2021) | 16% of total minutes (as of 2021) |

Conclusion

The data paints a clear picture of Formula 1's evolving approach to content distribution. While traditional TV remains the dominant medium, accounting for 84% of total viewing minutes in 2021, digital platforms are making a strong push. Between 2019 and 2021, digital consumption more than doubled, jumping from 7% to 16% of viewing time.

Regional differences highlight how infrastructure and habits influence viewing preferences. In the U.S., streaming has surged, making up 38.3% of viewing time, whereas Poland leans heavily on cable, with 33.2% of viewers opting for it compared to just 8.2% for streaming. Meanwhile, China presents an interesting mix - it boasts the largest TV audience globally, with 70.8 million unique viewers in 2021, but also leads in digital social media growth.

Age plays a major role in shaping viewing habits. Older fans (40+) stick to traditional broadcasts, while younger audiences are driving the move to digital. In the U.S., for example, 70% of Gen Z fans engage with F1 content daily via streaming and social media. This generational divide is forcing F1 to balance its strategy, maintaining strong TV partnerships for live events while heavily investing in digital storytelling to attract and retain younger viewers.

F1's strategy reflects this duality. The sport's shift toward subscription-based models - where 95% of TV rights spending now goes to premium channels - shows confidence in its loyal fanbase. At the same time, digital platforms are becoming the gateway for new fans, especially women, who make up 75% of F1's newest followers. The sport has transitioned from a focus on race weekends to an "always-on" model, with 61% of highly engaged fans consuming F1 content daily. By leveraging both traditional and digital platforms, F1 is successfully broadening its global reach while building a younger, more diverse audience for the future.

FAQs

Why is streaming growing faster in the U.S. than in many other countries?

Streaming is growing quickly in the U.S., driven by the increasing popularity of subscription services and OTT platforms. This shift has played a key role in expanding Formula 1's global audience, highlighting a broader move toward digital viewing and on-demand content.

How do pay-TV deals affect race viewership versus broadcast revenue?

Formula 1's broadcast revenue has surged thanks to lucrative pay-TV agreements. A prime example is ESPN's U.S. contract, which skyrocketed from $5 million per year in 2018 to an impressive $90 million recently. While these deals bring in substantial income, their effect on viewership is more complex. Digital platforms are seeing growth, but traditional TV audiences show uneven trends. Globally, TV audiences edged up to 1.6 billion in 2024, yet the average viewership per race has been declining year over year.

Will TV still matter for F1 once U.S. rights move to Apple TV in 2026?

TV is likely to stay a key player for Formula 1 in the U.S., even after its broadcasting rights shift to Apple TV in 2026. Recent figures highlight that traditional networks, such as ESPN, hit record-breaking viewership numbers in 2025. Live sports, in particular, continue to attract large TV audiences, despite the increasing dominance of digital streaming platforms.