F1 Fan Demographics: Age, Gender, and Regions

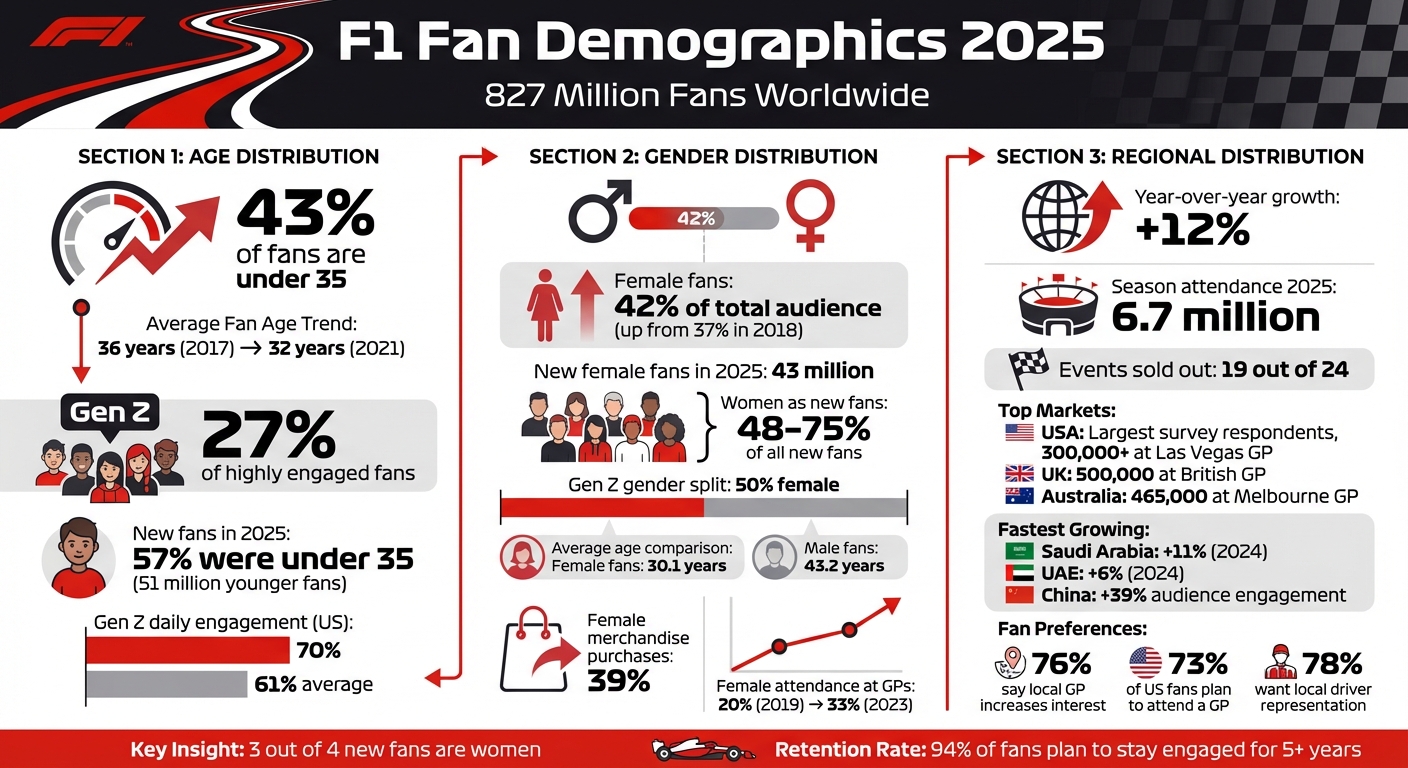

F1's fanbase transformed: 827M fans in 2025, 43% under 35, 42% female, with rapid growth in the U.S., Saudi Arabia and Asia-Pacific.

Formula 1’s fanbase has grown to 827 million worldwide in 2025, driven by younger audiences, women, and emerging markets like the U.S. and Saudi Arabia. Here’s a quick snapshot of how F1's audience is changing:

- Age: 43% of fans are under 35, with Gen Z making up 27% of highly engaged fans. The average fan age dropped from 36 in 2017 to 32 in 2021.

- Gender: Women now represent 42% of F1's audience, up from 37% in 2018. Women account for three out of every four new fans.

- Regions: The U.S. is now the largest market for fan growth, while Saudi Arabia and China are among the fastest-growing regions.

These shifts are reshaping how fans engage with the sport, from social media to live events, and are influencing F1's marketing, sponsorships, and race schedules.

F1 Fan Demographics 2025: Age, Gender, and Regional Distribution Statistics

F1's Female Fanbase SURGES! Why Women Are Leading the Charge in Motorsports

Age Distribution of F1 Fans

Formula 1's audience is skewing younger at an impressive rate. Currently, 43% of all F1 fans are under 35, with this younger group fueling much of the sport's growth. The steady decline in the average fan age highlights how effectively F1 has connected with younger generations.

In 2025 alone, 57% of new fans were under 35, adding a staggering 51 million younger fans globally. Gen Z, in particular, is making a big impact, now comprising 27% of highly engaged fans, with 66% saying they draw personal inspiration from F1 drivers or teams. This generational shift is reshaping how fans interact with the sport and what they value most.

Younger Fans and Recent Trends

Gen Z fans are redefining how Formula 1 is consumed. In the U.S., 70% of Gen Z fans engage with F1 content daily, well above the 61% average across all age groups. Unlike older fans, who often discovered the sport through TV broadcasts, younger audiences are coming to F1 through social media (12%) and streaming series like Drive to Survive (10%).

Digital platforms are central to this shift. More than half of the viewers watching F1 highlights on YouTube are under 35, and F1's social media following skyrocketed from 18.7 million in 2018 to an incredible 107.6 million by 2025. The trend is global, too - 40% of F1 fans in China are aged 16 to 34, reflecting the sport's widespread appeal to younger demographics.

But it’s not just about how they watch. 70% of Gen Z fans say Formula 1 represents a status or image they aspire to, and 59% of newer fans cite fashion and style as key reasons for their interest. Events like the "F1 75 Live" season launch at London’s O2 Arena, which featured acts like Take That and mgk, sold out in just 20 minutes - showing how F1 is tapping into youth culture and festival-style experiences.

Changes in Average Fan Age Over Time

The shift toward younger fans is backed by historical trends. Over just four years, the average fan age dropped from 36 to 32, marking one of the fastest demographic shifts in major sports. This acceleration can be traced back to Liberty Media’s 2017 acquisition of Formula 1, which focused on digital engagement and storytelling rather than relying solely on traditional TV broadcasts.

Werner Brell, CEO of Motorsport Network, summed up the transformation:

"Gen Z, women, and US fans are driving an always-on, connected, and culturally powerful era for F1".

The 2025 Global Fan Survey, which gathered over 100,000 responses from 186 countries, confirmed that younger fans are now the backbone of F1’s growth. This evolution is reshaping the sport’s strategies for content, marketing, and commercial success.

Gender Distribution in Formula One

Formula One is seeing a shift in its fanbase, with women making up a larger portion of its global audience. By 2025, women accounted for 42% of F1's audience worldwide, up from 37% in 2018. This growth is striking, with 43 million new female fans joining the sport in 2025 alone. Depending on the data source, women made up between 48% and 75% of new fans that year. Among Gen Z fans, the gender split is nearly even, with 50% of this group identifying as female. Interestingly, the average age of female fans is 30.1 years, significantly younger than the male average of 43.2 years.

Growth in Female Fans

The surge in female fans can be credited to F1's focus on storytelling and digital engagement. For half of younger and female fans, driver personalities are the main attraction. Netflix's Drive to Survive has played a pivotal role, introducing 16% of fans who started following the sport in the last five years. In the UK, 43% of the show's viewers are women.

The F1 Academy, an all-female racing series, has also been a game-changer. Currently, 42% of female fans follow the series, making it the second-most-followed championship after F1 itself. Susie Wolff, Managing Director of F1 Academy, explained the approach:

"We wanted to bring in a new audience than those previously involved, and that's why it's a 100% match".

Fashion and lifestyle have further boosted engagement. Sixty percent of new fans see fashion and style as an important part of their F1 experience, and 59% say it enhances their connection to the sport. This has led to partnerships with brands like Charlotte Tilbury and ELEMIS, the first beauty sponsors in global motorsport. In January 2024, Charlotte Tilbury became F1 Academy's first global technical partner, launching the Girls Karting Academy to provide free karting sessions for girls aged 8–12.

These efforts have not only attracted more fans but have also reshaped how fans engage with the sport, creating a more inclusive and balanced environment.

Evolution of Gender Balance

As F1's audience evolves, the sport is moving away from its traditionally male-dominated focus. Female fans, drawn to storytelling and driver personalities, are reshaping the narrative. While male fans often prioritize technical aspects and race strategies, women tend to engage more with the "narrative drama" of the sport. This engagement is evident in their purchasing behavior - 39% of female fans have bought team or driver merchandise, making them a highly active segment of the audience.

The way fans discover F1 also varies by gender. For 39% of female fans, especially those aged 25–34, friends and family are the primary introduction to the sport. In contrast, older male fans often discover F1 through traditional TV coverage. This shift is visible at live events too, with female attendance at Grands Prix rising from 20% in 2019 to nearly 33% by 2023. In the U.S., 41% of women surveyed said they are more likely to purchase products from F1 sponsors, highlighting the commercial impact of this growing demographic.

F1's integration into popular culture has also played a role in this transformation. Stefano Domenicali, President and CEO of Formula 1, summed it up:

"The sport is embedded in culture now, via streaming, storytelling, and social media, and that's helping more people connect".

This shift isn't limited to fans. Women now make up 38% of the F1 workforce, a jump from 28% in 2017. In January 2025, Laura Mueller made history as the first female Race Engineer in F1, working with Haas driver Esteban Ocon.

Regional Distribution of F1 Fans

Formula One's global presence has grown significantly, with its fanbase increasing by 12% year-over-year. While Europe remains the sport's largest and most established market, the fan landscape is shifting, with new regions contributing to F1's rapid expansion.

The United States now holds the largest share of respondents in the 2025 Global Fan Survey, surpassing all other countries. This marks a major shift in F1's focus, as 70% of Gen Z fans in the U.S. engage with F1 content daily. Having a home race plays a big role in fan interest - 76% of fans say a local Grand Prix makes them more likely to follow the sport. As a result, season attendance hit 6.7 million in 2025. These changes highlight the growing importance of the U.S. and other emerging markets in shaping F1's future.

Major Regional Markets

The trends in F1's regional growth align with its younger, more diverse audience. While the U.S. is leading the charge in dynamic growth, traditional markets like Europe remain the backbone of the sport.

Europe, F1's historical stronghold, continues to thrive. The British Grand Prix saw 500,000 attendees in 2025, showcasing the region's deep motorsport roots. With the highest density of teams and facilities, Europe benefits from a long-standing motorsport culture. For 39% of European fans, family and friends are their main introduction to F1, reflecting the sport's intergenerational appeal.

The United States, however, has become F1's most exciting growth market. In October 2025, F1 signed a five-year exclusive broadcast deal with Apple TV, starting in 2026, driven by the sport's growing digital engagement in the U.S.. The Las Vegas Grand Prix drew over 300,000 attendees in 2025, and 73% of U.S. fans expressed plans to attend a Grand Prix in the future.

Australia also remains a key market, with the Melbourne Grand Prix attracting 465,000 fans in 2025. Meanwhile, China and India are emerging as crucial areas of growth, with many fans in these countries following the championship for less than five years, signaling successful recent outreach. Following the return of the Shanghai Grand Prix, China saw a 39% increase in audience engagement.

Growth Markets and Expansion Areas

Saudi Arabia has become F1's fastest-growing market, with an 11% increase in fans year-over-year in 2024. The United Arab Emirates follows closely with 6% growth over the same period. Jon Stainer, Global General Manager at Nielsen Sports, explained this surge:

"Growth of interest, especially among women and newer markets like Saudi Arabia can be attributed largely by a shift in how the teams and drivers are profiled today, and the access they are affording global audiences".

Additionally, regions like the Middle East, Asia-Pacific, and Africa have seen survey response rates double in recent years, reflecting F1's expanding global footprint. This growth aligns with the sport's strategy of adding races in emerging territories. In 2025, 19 out of 24 events sold out completely, emphasizing the high demand for live F1 experiences worldwide. F1's integration into mainstream culture through streaming platforms and social media has been a key driver of this expansion. Stefano Domenicali highlighted this shift:

"The sport is embedded in culture now, via streaming, storytelling, and social media, and that's helping more people connect".

Key Trends and What They Mean for Formula One

Formula One's fanbase is evolving, and with it, the sport is undergoing a transformation in how it engages with audiences. What was once a "race weekend only" focus has shifted to an "always-on" content strategy. This isn't just about being active on social media - it's about embedding F1 into broader cultural conversations.

Stefano Domenicali, F1's President & CEO, summed up this shift:

"Increased diversity and a younger audience will enable us to be richer in terms of being able to capture the attention of more people. That's really something that we've seen the effect by having the right language, the right narrative and the right tools that are closer to how the younger generation is working and behaving".

This shift has led to a dual approach in digital content, catering to both the sport's traditional supporters and its newer, younger fans.

Effects on Digital Engagement and Content

F1's content strategy has become more nuanced, targeting different audience segments with tailored approaches. For legacy fans, the sport continues to deliver in-depth technical analysis, which remains a key draw. A whopping 80% of these fans rely on websites and articles for their F1 updates. Meanwhile, 90% of newer fans - many of whom are younger - consume their F1 content through social media platforms like TikTok, Instagram, and YouTube. To address these preferences, F1 produces a mix of short, lifestyle-focused content alongside traditional long-form analysis.

Driver personalities have also become a major driver of fan engagement. In fact, 40% of U.S. fans follow drivers more closely than teams or even the sport itself. This shift has led to partnerships that elevate drivers as global icons. For instance, F1's 10-year deal with Louis Vuitton and the presence of celebrities like Rihanna at races highlight how the sport is blending fashion and lifestyle into its identity. This resonates with the 59% of emerging fans who say style plays a big role in their love for the sport.

The numbers show just how effective this strategy has been. The Las Vegas Grand Prix in November 2025 generated 1.8 billion social media impressions and 450 million video views, thanks to contributions from over 1,200 content creators. Meanwhile, F1 The Movie, starring Brad Pitt, grossed over $630 million in June 2025, becoming the highest-grossing sports film ever and topping Apple TV streaming charts. These successes go beyond marketing - they're bringing in entirely new audiences who might not have tuned in to a race otherwise.

Another key initiative is the F1 Academy, which has become hugely popular among female fans and Gen Z. It's now the second most-followed series after F1 itself, with 42% of female fans and 37% of Gen Z fans watching. This aligns with the fact that three out of four new fans entering the sport are women.

While these efforts are paying off in terms of engagement, they also highlight challenges in scaling the sport's commercial opportunities.

Future Growth Opportunities and Obstacles

The changing demographics of F1 fans bring exciting opportunities for growth. Gen Z fans, for example, are 40% more likely to buy from F1 sponsors compared to the broader fanbase (40% vs. 33%). Female and Gen Z fans are also enthusiastic about team merchandise, with 39% and 38% of them making purchases, respectively. Werner Brell, CEO of Motorsport Network, highlighted the potential in these groups:

"Gen Z, women, and US fans are driving an always-on, connected, and culturally powerful era for F1. It points to how we can better serve fans, connect them with partners, and seize the biggest commercial opportunities for the sport's future".

The Asia-Pacific region also stands out as a fertile ground for growth, with 50% of fans expressing strong intent to purchase F1-sponsored products. However, tapping into these markets comes with its own hurdles. Local representation is a critical factor - 78% of fans say they'd be more interested if a local driver competed, and 76% say a home race would boost their engagement. This creates a tricky situation: building interest in new markets often requires local heroes, but investing in local talent requires an existing fanbase.

The sport also faces the challenge of balancing its content strategy. Meeting the demands of longtime fans who crave technical depth while simultaneously creating personality-driven, accessible content for newcomers requires significant resources. F1's five-year U.S. broadcast deal with Apple TV, starting in 2026, reflects its commitment to a digital-first approach. And with 73% of U.S. fans planning to attend a Grand Prix in the future, the stakes are high to turn online engagement into lasting loyalty across all platforms and demographics.

Conclusion

Formula One has seen a remarkable shift in its fanbase, growing from a niche motorsport following to a global sensation. The numbers highlight this evolution: by 2025, the sport had captivated 827 million fans worldwide, with 43% under 35 and 42% identifying as female. Even more striking, women account for three out of every four new fans, underscoring a major shift in F1's appeal and engagement strategies.

These statistics are more than just figures - they reflect a generational shift that’s redefining how the sport connects with its audience. F1 has successfully woven itself into mainstream culture through streaming platforms, social media, and compelling storytelling, moving beyond the confines of race weekends. With 94% of fans expressing plans to stick with the sport over the next five years, the groundwork for continued growth is firmly in place.

The challenge ahead is maintaining this momentum while addressing the diverse expectations of its audience. Longtime fans value the technical intricacies of the sport, while newer followers are often drawn to driver personalities and lifestyle content. Expanding its reach, especially in regions like the Americas and Asia-Pacific, offers immense potential. Notably, 76% of fans say a local Grand Prix increases their likelihood of following the sport. How F1 adapts to these demographic and regional dynamics will determine its ability to sustain its current popularity and transform it into lasting commercial success. Balancing innovation, accessibility, and representation will be key to keeping fans engaged for years to come.

FAQs

How is F1 attracting so many Gen Z fans?

F1 is connecting with Gen Z fans by focusing on storytelling, digital engagement, and staying in tune with their interests. Surveys reveal that nearly half of Gen Z followers interact daily with driver storylines and social media content. Features like streaming platforms, behind-the-scenes access, and initiatives promoting diversity align with their values. Meanwhile, expanding its presence in regions like the U.S. and Middle East enhances its appeal. This fresh, narrative-focused strategy helps make F1 more engaging and relatable for younger audiences.

What’s driving the rise in female F1 fans?

The increase in female Formula 1 fans is fueled by a shift in storytelling, stronger digital engagement, and an appeal that extends beyond just racing. Surveys reveal that women now represent 25% of the fanbase, with three out of four new fans being female. The F1 Academy's rising popularity - closely followed by 42% of female fans - along with focused marketing strategies, has been instrumental in drawing in younger, more diverse audiences, particularly women.

Why is F1 growing so fast in the U.S. and Saudi Arabia?

Formula 1 (F1) has seen a surge in popularity in both the U.S. and Saudi Arabia, thanks to a growing global fan base. Younger audiences, including women and Gen Z, are playing a key role in driving this interest. The sport's appeal has also been amplified by an expanded race calendar and more extensive media coverage, which have helped bring F1 into the spotlight in these regions.