Rising Freight Costs: F1 Teams' Response

Formula 1 teams are grappling with rising freight costs amid an expanded race calendar, prompting innovative logistics strategies to maintain competitiveness.

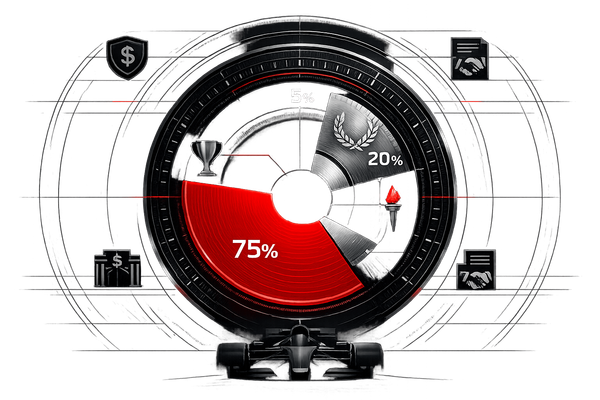

Formula 1 teams are facing rising freight costs in 2025, with logistics expenses now consuming a large share of their $135 million budget cap. The expanded 24-race calendar, global inflation, and higher fuel prices have driven freight costs to as much as $20 million per team annually. Teams must now make tough choices between logistics spending and performance investments like car upgrades.

Key strategies include:

- Switching to sea freight for non-critical items to save up to $800,000 per year.

- Using multiple equipment sets to reduce reliance on costly air freight.

- Planning months in advance to optimize routes and minimize disruptions.

- Collaborating with logistics partners like DHL to manage over 1,200 tons of cargo per race.

These efforts not only help teams stay under the cost cap but also prepare them for future challenges, including new teams joining in 2026 and stricter sustainability goals. By balancing cost control with operational efficiency, teams aim to maintain competitiveness on the track while navigating the logistical demands of a growing F1 calendar.

How Formula 1 Travels Across The World | F1 Logistics Explained | DHL

Freight Cost Trends in Formula One

F1 teams are now spending anywhere from $8 million to $20 million per season on freight. This sharp rise from previous years is a result of several factors that have reshaped how teams manage their global logistics.

What's Driving Higher Freight Costs

The expansion of the 2025 F1 calendar to 24 races is a key contributor to the surge in freight expenses. With events spread across five continents and races packed closer together, teams are transporting equipment more frequently than ever. On average, they now cover 80,000 to 100,000 kilometers per season, moving massive amounts of cargo.

Air freight costs have skyrocketed, exceeding $1 million per shipment per race. The combination of rising global fuel prices and increased demand for air cargo space has made air transport a financial burden. Despite the high costs, the speed and reliability of air freight are critical - especially for essential components that may require a seven-hour turnaround.

Geopolitical issues and unexpected disruptions add to the logistical headaches. For instance, Typhoon Hagibis during the 2018 Japanese Grand Prix forced teams to make costly, last-minute shipping changes. Similarly, customs delays at the 2019 Brazilian Grand Prix led to expensive expedited shipping to meet tight schedules.

The expanded race calendar has also created logistical bottlenecks. Triple-headers and back-to-back races across continents make traditional shipping methods less viable. Items that were once shipped by sea for about $200,000 per shipment now often require air transport to meet deadlines, further inflating costs.

These challenges are forcing teams to rethink how they handle logistics and manage costs.

How Freight Costs Affect Team Operations

The impact of rising freight expenses extends beyond logistics - it’s reshaping how teams allocate their budgets. With the F1 cost cap in place, freight now takes up a significant share of resources. While F1 provides an additional $1.8 million allowance for every race beyond 21, this increase only partially offsets the rising logistical expenses.

Teams face tough choices. Money spent on expedited shipping is money that can’t go toward aerodynamic upgrades, engine improvements, or hiring top talent. This financial pressure has led to new strategies for managing equipment and race preparation.

For example, Aston Martin has invested in six identical sets of equipment, each valued at $2.6 million, to reduce reliance on air freight. Other teams have shifted some items, like timing stands, to sea freight. While slower, this approach can save up to $325,000 per season.

Logistics planning has also become more intensive. Teams now start planning for the next season months in advance, working closely with partners like DHL and CEVA to secure shipping rates and routes.

The scale of F1 logistics is staggering. Across all teams, about 1,200 tons of equipment is transported for each race weekend. And with new entrants like Cadillac expected to join in 2026, these figures are set to grow, further straining global shipping infrastructure and pushing costs even higher.

How F1 Teams Are Managing Rising Freight Costs

F1 teams are rethinking their logistics strategies to tackle soaring freight expenses, focusing on balancing speed, cost, and reliability across their global operations.

Choosing Between Air, Sea, and Road Freight

Freight decisions have become a calculated process, with teams carefully assessing the urgency of transporting each piece of equipment.

Air freight is the premium choice for race-critical components like cars, engines, and key technical gear. While undeniably expensive, it’s indispensable for items that might need to move within a tight seven-hour window between races. Teams limit this costly option to equipment that directly impacts their performance on race day.

For nonessential items, sea freight is the preferred alternative. Teams like Aston Martin use this method for transporting garage infrastructure and hospitality equipment. The cost difference is staggering - around $200,000 per shipment by sea compared to over $1 million by air. Sea freight is ideal for bulky items that don’t need to arrive immediately at the circuit.

Road freight dominates within Europe, where shorter distances and simpler customs processes make it a practical and reliable option.

| Freight Mode | Cost Level | Speed | Usage |

|---|---|---|---|

| Air | Highest ($1M+ per race) | Fastest | Critical race equipment, tight schedules |

| Sea | Lowest (~$200,000) | Slowest | Nonessential, bulky items |

| Road | Moderate | Variable | Short distances within Europe |

This careful selection of freight modes has paved the way for further logistical innovations like equipment leapfrogging.

Equipment Leapfrogging and Multiple Equipment Sets

Aston Martin employs six identical equipment sets, each worth about $2.4 million. This approach allows them to send different sets to various locations well ahead of time.

The leapfrogging strategy works like this: while one set is in use at a race, others are already en route to future venues via slower, more economical transport methods. For instance, after a race in Japan, spare equipment might head directly to Montreal, avoiding the need for costly expedited shipping.

The financial savings are notable. Shipping a timing stand by sea instead of air can save up to $250,000 over a season. With equipment typically lasting 5–10 years, the initial investment in multiple sets usually pays off within one or two years. Teams generally maintain four to six sets stationed strategically worldwide, ensuring smooth operations even in the face of delays or unexpected challenges.

This operational efficiency aligns closely with the teams’ efforts to adopt more environmentally friendly logistics practices.

Green Logistics Practices

In F1 logistics, cost-saving measures and sustainability are becoming increasingly interconnected. Eco-conscious decisions often lead to financial savings.

Route optimization is a key tactic, cutting emissions and costs by consolidating shipments and avoiding unnecessary detours. This reduces fuel consumption and the associated expenses.

Switching to sea and road freight not only lowers costs but also significantly reduces carbon emissions. Sea freight, in particular, has a much smaller environmental footprint per ton of cargo, making it an attractive option for teams aiming to align with broader sustainability goals.

Teams are also exploring innovative approaches, such as improved packaging and alternative energy-powered transport. DHL, F1’s primary logistics partner for over 20 years, plays a major role in this effort. Each season, they handle the movement of 1,400 tons of goods through green logistics initiatives. Their expertise helps teams minimize both their environmental impact and their freight expenses.

Regional Freight Cost Differences and Planning

The global F1 calendar creates unique logistical challenges, with freight costs and planning varying widely by region. Teams must tackle these differences while ensuring smooth operations across continents.

Cost Differences: Europe vs. Asia-Pacific

Regional variations in freight costs significantly impact logistics strategies. Europe offers the most cost-efficient environment for F1 teams. Short distances between venues, well-established road networks, and simplified customs processes make Europe a logistical haven. Teams primarily rely on road transport, which is both economical and reliable.

In contrast, freight costs in the Asia-Pacific region are much higher due to longer distances, intricate customs procedures, and varying infrastructure quality. Transporting equipment often requires costly air freight or extended sea freight, which demands months of preparation. Additionally, some Asia-Pacific locations face limitations in port capacity or lack specialized handling equipment, further driving up costs.

Geopolitical factors also complicate logistics in Asia-Pacific. Teams must account for potential airspace restrictions, regional conflicts, and disruptions near critical shipping lanes like the Suez Canal. These risks can lead to expensive rerouting, adding layers of complexity rarely encountered in European races.

| Region | Freight Cost Level | Key Advantages | Primary Challenges |

|---|---|---|---|

| Europe | Lower | Road transport, simple customs, short distances | Limited to regional races |

| Asia-Pacific | Significantly Higher | Large fan markets, strategic importance | Long distances, complex customs, geopolitical risks |

| Middle East | Variable | Central location for routing | Variable infrastructure, customs complexity |

The financial implications are substantial. For example, while European races often require fewer equipment sets and shorter lead times, Asia-Pacific events push teams like Aston Martin to maintain multiple equipment sets strategically positioned around the globe.

These regional cost differences directly shape decisions about equipment leapfrogging and transport methods.

Managing Triple-Headers and Back-to-Back Races

Beyond regional cost challenges, the F1 schedule often adds logistical pressure, especially during triple-headers or back-to-back races. These tight schedules force teams to carefully coordinate equipment movements to ensure timely arrivals.

Take the 2025 season's triple-header sequence - China, Japan, and Bahrain - as an example. F1's logistics team managed air freight for immediate needs from China to Japan while simultaneously coordinating sea freight from Europe to Bahrain via Jeddah. Critical broadcast equipment was flown in, while less urgent items were shipped by sea to meet deadlines.

Temporary storage solutions play a vital role during these busy periods. Teams arrange warehousing near circuits for early-arriving equipment, avoiding the high costs of last-minute air freight. These staging areas allow teams to position gear strategically without incurring premium storage fees at race venues.

A smart routing strategy further enhances efficiency. For instance, containers used at the Mexican Grand Prix are shipped directly to China, bypassing a return trip to the UK. After the Chinese Grand Prix, the same equipment continues to North America for races in Miami and Montreal before heading back to the UK for servicing. This direct routing minimizes transit time and air freight costs while ensuring seamless equipment utilization across regions.

Efficiency doesn’t stop at routing. Teams rely on historical data to refine their logistics strategies, analyzing transit times, customs clearance durations, and potential bottlenecks. This data-driven approach helps build buffer time into critical shipments, ensuring smooth operations even under tight timelines.

Collaboration with logistics partners like DHL is key to navigating these challenges. Their expertise in handling customs, securing storage, and mitigating disruptions enables teams to focus on racing, knowing their equipment will arrive on time and in the right condition.

Budgeting and Cost Cap Management

Formula One's $135 million cost cap has dramatically changed how teams manage freight budgets. Freight expenses, which range between $8 million and $20 million, play a critical role in staying within this limit. The FIA's cost cap rules allocate a base amount for a standard 21-race season, with an additional $1.8 million for each extra race. Teams that exceed this cap face serious consequences, like financial penalties, points deductions, or other sanctions, making strict budget adherence non-negotiable. In a sport where every dollar counts, saving money on freight can directly boost on-track performance.

Predicting Freight Costs

Accurate predictions of freight costs are essential to staying under the cost cap. As soon as the race calendar is announced, teams collaborate with logistics coordinators to estimate expenses for air, sea, and road freight. Early planning is critical because freight rates can swing wildly due to factors like fuel surcharges, route adjustments, or geopolitical issues. To stay ahead, teams rely on historical data, market trends, and logistics management software to track expenses in real time and flag any unexpected variances.

When costs spike unexpectedly, teams adjust by shifting non-essential items from air freight to slower, more affordable sea freight. Essential equipment gets prioritized for faster delivery, and upgrades might be delayed to cut down on expenses. Regional cost differences also play a big role - Asia-Pacific races, for instance, demand higher budgets due to longer transit times and elevated air freight rates compared to European races. These detailed forecasts not only help teams control costs but also strengthen their long-term logistics strategies to handle unpredictable expenses.

Working with Logistics Partners for Cost Control

Turning cost forecasts into real savings requires strong partnerships with logistics providers. Take DHL, for example, which has managed F1 logistics for two decades and recently extended its contract for another nine years. These partnerships help teams optimize shipping routes, negotiate bulk rates, and minimize delays, all of which are crucial for staying on budget. Logistics providers also offer real-time tracking, contingency planning, and advice on the most cost-effective transport options.

Aston Martin, for instance, works closely with its logistics partner to refine shipping methods and reduce reliance on costly air freight. One example is their decision to move a 2,200-pound timing stand from air to sea freight, a strategic choice that saved money without compromising operations. Beyond cost savings, these partners also help teams manage risks, such as dealing with typhoons during the 2018 Japanese Grand Prix or customs delays at the 2019 Brazilian Grand Prix. By combining smart budgeting with reliable logistics support, teams are better equipped to handle rising freight costs and the challenges of an ever-evolving race calendar.

Expert Views on F1 Freight Challenges

Industry insiders are closely examining how Formula 1 teams are tackling the rising costs of freight. With logistics budgets stretching from $8 million to $20 million per season, teams are crafting clever strategies to stay within cost caps while maintaining their competitive edge.

Franco Massaro from Aston Martin has adopted an interesting approach by using six identical sets of equipment, each valued at about $2.4 million. This strategy significantly reduces reliance on air freight and saves the team nearly $300,000 annually on timing stands alone. These kinds of measures highlight how teams are finding a balance between different freight methods to manage their growing expenses.

The scale of F1 logistics is massive. DHL, the sport’s primary logistics partner, handles over 1,200 tons of cargo per race weekend, utilizing up to seven Boeing 747 cargo planes to get everything where it needs to be. Each team contributes roughly 50 tons of cargo per season, with DHL covering more than 80,000 miles annually to support the global race calendar. These insights underline the sheer magnitude of F1's logistical operations and the challenges that come with it.

Future Challenges for 2026 and Beyond

Looking ahead to 2026, the logistical picture is expected to become even more complicated. With new teams like Cadillac likely joining the grid, the total equipment volume is set to surpass the current 1,200 tons per race. This growth will put additional pressure on logistics networks, requiring more containers, transport resources, and advanced scheduling systems to keep operations running smoothly.

Another major hurdle will be the shift to 100% sustainable fuels by 2026. Teams will need to overhaul their infrastructure and possibly rethink how they transport equipment to align with F1's ambitious sustainability goals. On top of that, the removal of the MGU-H system in the 2026 regulations will mean teams have to ship redesigned power units, adding yet another layer of complexity to an already intricate operation.

The expanded race calendar and the increasing number of triple-header weekends will only add to the strain, demanding more agile logistics planning and additional equipment sets to keep up.

New Solutions for Efficient Logistics

Faced with these mounting challenges, teams are stepping up their game with smarter logistics strategies. Digital route optimization tools are becoming a game-changer, helping teams pinpoint the fastest and most cost-effective shipping routes. These tools also provide real-time tracking, allowing teams to dynamically adjust plans based on changing conditions and make informed decisions about freight methods.

Lightweight, modular equipment designs are another promising innovation. By creating components that can be packed more efficiently, teams can maximize container space, reduce the number of shipments, and gain more flexibility when deploying equipment across various venues.

Alternative transport methods are also gaining popularity. For example, teams are increasingly turning to rail transport for certain European routes and exploring advanced packing techniques to make better use of container space. Predictive analytics and advanced tracking systems are further revolutionizing supply chain management, enabling teams to anticipate disruptions and prepare contingency plans. This proactive approach has already proven its worth during events like Typhoon Hagibis in Japan (2018) and customs delays in Brazil (2019), where careful planning minimized disruptions.

Sustainability is playing a bigger role in shaping F1 logistics. Teams are prioritizing sea freight for its lower carbon footprint and experimenting with green practices such as using biofuels and electric vehicles for road transport. These efforts not only align with F1's environmental objectives but also offer cost-saving opportunities through reduced fuel consumption and optimized routing.

Finally, the partnership between teams and logistics providers continues to deepen. This collaboration allows teams to tap into specialized expertise and resources, enabling them to focus on what they do best - delivering top-tier racing performance on the track.

Conclusion: Managing F1's Freight Future

The logistics of Formula 1 are nothing short of intricate, but the sport has shown a knack for turning challenges into opportunities. With logistics budgets ranging from $8 million to $20 million per season, teams have managed to transform what could be a financial burden into a competitive edge through smarter strategies and execution.

One standout tactic is equipment leapfrogging, which has significantly cut costs and shifted the approach from reactive to proactive. Take this for example: moving a 1,000 kg timing stand by sea instead of air can save nearly $310,000 in a single season. By blending leapfrogging with forward-thinking logistics, teams have redefined how they operate under tight constraints.

Strong planning and close partnerships are now pillars of F1’s logistics game. This level of preparation is critical, especially when the unexpected strikes, like typhoons disrupting schedules in Japan.

Beyond operational efficiency, sustainability has become a central theme in cost management. Teams are discovering that eco-friendly practices - such as prioritizing sea freight and optimizing routes - align perfectly with their financial goals. And with the sport’s commitment to using 100% sustainable fuels by 2026, environmental responsibility is no longer just a regulatory requirement but a strategic move.

The road ahead isn't without hurdles. The entry of new teams like Cadillac and an expanding race calendar will push the total equipment volume beyond the current 1,400 tons per season. However, investments in digital tools, modular gear, and predictive analytics have already laid a solid foundation. These advancements allow teams to anticipate and address disruptions before they escalate.

Success in this evolving landscape will hinge on a team’s ability to balance bold innovation with practical decision-making. By embracing technology, sustainability, and adaptability, teams can navigate the complexities of logistics as skillfully as they tackle the challenges on the track. In the end, F1’s freight future will be shaped by the ingenuity and collaboration of those rising to meet these demands.

FAQs

How do F1 teams handle rising air freight costs while ensuring fast transport?

Formula One teams are finding creative ways to manage the growing costs of air freight. One effective approach has been shifting non-urgent equipment to sea freight, which is far more economical than air transport. For critical items like car components, teams are meticulously planning shipments to cut costs without sacrificing performance.

They’re also using advanced planning tools to consolidate shipments and make their operations more efficient. By collaborating closely with logistics partners and considering alternative transport routes, teams are striking a balance between cost savings and the speed they need to stay ahead - both on the track and off.

How do logistics partners like DHL help F1 teams manage rising freight costs?

Logistics partners like DHL are essential in managing the increasing freight expenses faced by Formula One teams. They craft customized strategies to streamline transportation routes, combine shipments effectively, and navigate customs processes smoothly, cutting down on delays and extra costs.

With their extensive global networks and expertise in handling time-critical logistics, these partners ensure that equipment is delivered reliably and on budget. This allows teams to concentrate on their performance rather than worrying about supply chain complications. Their skill in adjusting to regional variations in regulations and expenses plays a vital role in maintaining seamless operations throughout the F1 season.

How are F1 teams adapting their freight strategies to meet sustainability goals?

Formula One teams are putting a stronger focus on sustainability in their logistics operations, particularly in how they handle freight. To cut down on their environmental footprint, many teams are turning to fuel-efficient transportation methods, streamlining shipping routes, and combining shipments to reduce unnecessary trips. Some teams are even exploring alternative fuels and hybrid technologies to make their freight operations greener.

On top of that, teams are collaborating with logistics partners to meet carbon reduction goals and adopt smarter strategies, like opting for sea freight instead of air freight whenever schedules allow. These efforts not only reduce carbon emissions but also align with Formula One's larger goal of reaching net-zero carbon emissions by 2030.