How Constructor Performance Trends Shape Championships

Car performance, reliability, upgrades and team consistency drive F1 Constructors' titles and determine prize-money outcomes.

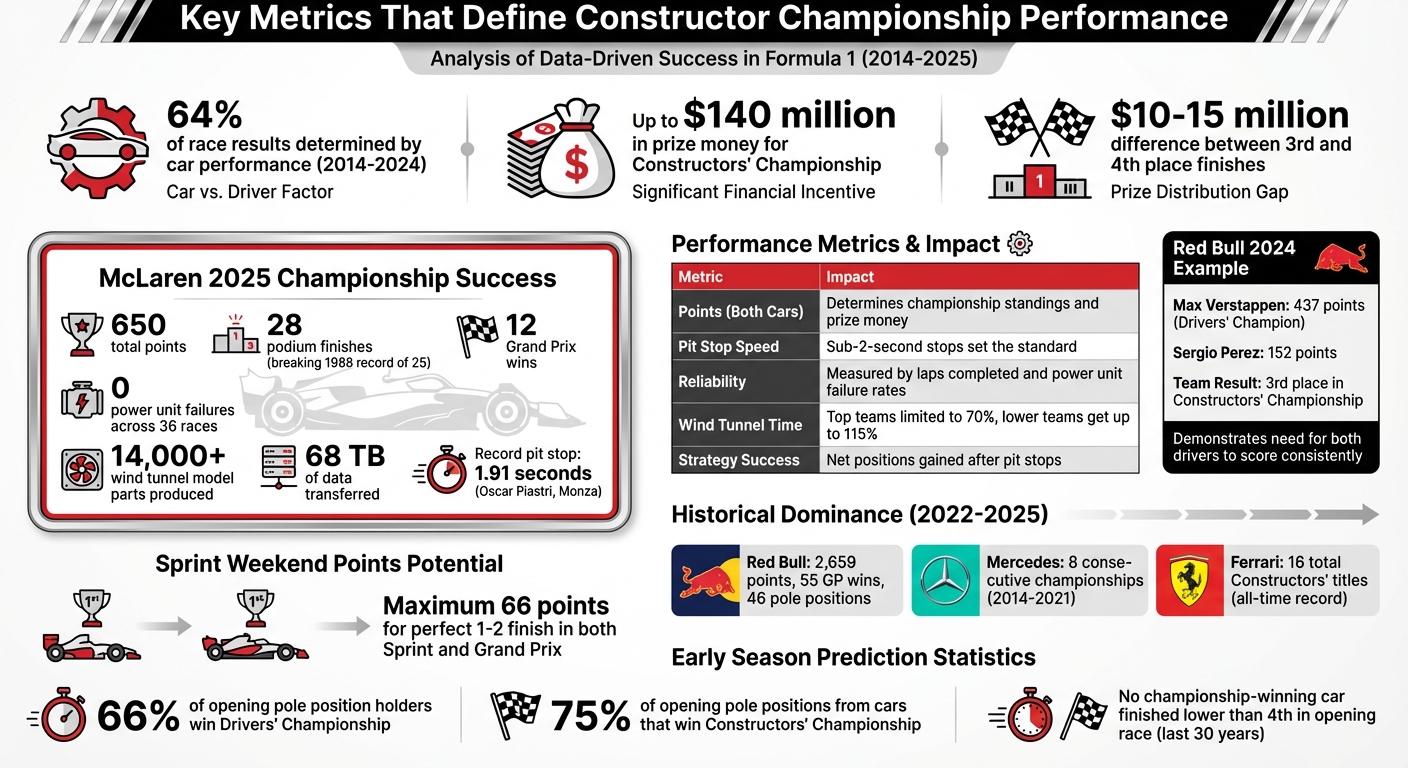

Constructor performance plays a bigger role than driver skill in Formula 1 success. Over 64% of race results (2014–2024) were determined by car performance. Teams rely on engineering, reliability, and consistent scoring from both drivers to secure the Constructors' Championship, which awards up to $140 million in prize money. Key factors include:

- Points from Both Drivers: Success depends on contributions from the entire team, not just one standout driver.

- Reliability: Avoiding power unit failures and DNFs is critical for consistent scoring.

- Upgrades and Development: Teams like McLaren in 2025 achieved dominance through precise, data-driven upgrades.

- Wind Tunnel Time: FIA's sliding scale limits aerodynamic testing for top teams, forcing efficiency.

- Regulation Changes: Adjusting quickly to new rules, like 2026's engine updates, can shift the competitive order.

McLaren's 2025 success - 650 points, 28 podiums, and zero power unit failures - highlights how mastering these areas leads to championships. Fans and analysts use data trends to predict outcomes, with early-season performance often foreshadowing title winners. Constructor performance isn't just about speed; it's about strategy, reliability, and maximizing resources.

Every 2025 F1 car’s strongest and weakest points

Key Metrics That Define Constructor Performance

Key Metrics Defining F1 Constructor Championship Performance

The Constructors' Championship hinges on a straightforward yet challenging principle: a team's success depends on points earned by both drivers. Unlike the Drivers' Championship - where a single standout performer can dominate - this title demands consistent contributions from both teammates. A clear example of this dynamic unfolded in 2024 with Red Bull Racing. While Max Verstappen amassed an impressive 437 points to clinch the Drivers' Championship, his teammate Sergio Perez only managed 152 points. This disparity ultimately cost Red Bull the Constructors' Championship, leaving them in 3rd place.

Podium Rates and Points Accumulation

Sprint weekends have raised the stakes for teams, emphasizing the importance of maximizing points from both cars. A flawless Sprint weekend - where teammates finish 1-2 in both the Sprint and the Grand Prix - can yield a massive 66 points. Podium finishes, in particular, are critical for building momentum. Take McLaren's 2025 season as an example: by Round 18, the team had achieved a staggering 28 podiums, breaking their 1988 record of 25. This relentless consistency created an unassailable lead, securing the championship with several races still to go.

While podium finishes keep the points tally climbing, technical advancements often serve as the edge teams need to maintain their dominance.

Technical Development and Upgrade Speed

The pace at which teams develop and implement upgrades can make or break their season. During 2025, McLaren pushed boundaries by producing over 14,000 wind tunnel model parts as part of their aggressive development plan. This high output allowed them to refine their aerodynamics and enhance on-track performance.

However, sheer production isn't enough - accuracy is key. The term "correlation" refers to how well simulation data from tools like wind tunnels and computational fluid dynamics (CFD) matches actual track results. For instance, McLaren tested a new front wing during Friday practice at the Canadian Grand Prix in June 2025. Rather than rushing to use it in the race, they analyzed the data back at their Woking headquarters. Only after confirming the correlation did they introduce the part at the Austrian Grand Prix, contributing to their impressive 650-point season total.

"The fundamentals don't only involve the capacity to generate ideas... they also involve understanding the methodologies you use for this development – and understanding when these methodologies will... actually transfer into something that works trackside." – Andrea Stella, Team Principal, McLaren

Precision also extends to race-day operations. A standout example is McLaren's record-setting pit stop of 1.91 seconds for Oscar Piastri at Monza in 2025. Sub-2-second stops have become the gold standard, and teams also measure success by "net positions gained" - the number of places a driver gains or loses after factoring in pit strategies.

Reliability and Response to Regulation Changes

Reliability might not grab headlines, but it often decides championships. Consistent top-five finishes can outweigh the occasional win if paired with a costly Did Not Finish (DNF). McLaren's 2025 campaign showcased this perfectly: across 36 races (including Sprints), they experienced zero power unit failures. This reliability allowed both drivers to consistently score points, creating a buffer that ultimately secured their title.

For midfield teams, reliability can mean the difference between survival and stagnation. Williams Racing, for instance, climbed to 5th in the standings with 70 points in 2025, thanks to Alexander Albon scoring in 9 of the first 14 weekends. However, cooling-related retirements in Spain and Austria highlighted how fragile progress can be. In the tightly contested midfield, even a single double-points finish can dramatically alter standings.

Adapting to regulation changes adds yet another layer of complexity. The FIA's sliding scale for wind tunnel time limits higher-ranking teams to just 70% of the base aerodynamic testing allowance, while lower-ranking teams receive up to 115%. This forces top teams to focus on efficiency. With major regulation changes on the horizon - like the 2026 engine and chassis updates - teams must juggle current car performance with long-term development for future standards.

| Metric | Impact on Constructor Performance |

|---|---|

| Points (Both Cars) | Determines championship standings and prize money |

| Pit Stop Speed | Operational benchmark; sub-2-second stops set the standard |

| Reliability | Measured by laps completed and power unit failure rates |

| Wind Tunnel Time | Limited for top teams to maintain competitive balance |

| Strategy Success | Assessed by net positions gained after pit stops |

Historical Constructor Performance Patterns

Regulation changes often create waves of performance shifts, giving teams that adapt quickly an edge that can last for years. These trends are key to predicting championship outcomes, as history shows which teams excel during such transitions. A standout example is Mercedes' dominance during the hybrid era, where they clinched eight consecutive Constructors' Championships from 2014 to 2021. Their success came from prioritizing thermal efficiency and energy recovery systems, setting a benchmark others struggled to match.

Periods of Dominance and Long-Term Success

Championship victories are driven as much by team performance as by driver skill. Red Bull Racing’s recent success underlines this idea: between 2022 and 2025, they amassed 2,659 points, 55 Grand Prix wins, and 46 pole positions, all under the ground-effect regulations. Adrian Newey’s expertise in underfloor aerodynamics gave Red Bull a strong foundation during this period.

Ferrari, holding the record with 16 Constructors' titles, and Williams, who dominated the 1990s with nine championships, also highlight how technical leadership shapes success. Williams, for instance, benefited from designers like Newey during their peak years. However, even the best teams face downturns. By August 2025, Red Bull’s dominance had faded - they dropped to 4th in the standings with just 194 points. This decline led to a major leadership change, with Christian Horner being replaced by Laurent Mekies in July 2025.

How Rule Changes Reshape Performance

The 2022 shift to ground-effect aerodynamics represented the biggest regulatory overhaul since the hybrid engine era began in 2014. This change moved the focus from upper-body aerodynamics to underfloor performance, shaking up the competitive order. Mercedes’ "zero-pod" concept proved problematic, causing aerodynamic instability and porpoising issues. As a result, their eight-year title streak ended, with the team managing only seven wins over the next four seasons. In contrast, Red Bull thrived, securing 55 victories during the same period.

Ferrari’s performance during the ground-effect era tells another story. Despite achieving 24 pole positions between 2022 and 2025 - the second-highest total - they only managed 10 race wins. Weak tire management and strategic missteps prevented them from converting qualifying speed into consistent race success. On the other hand, McLaren’s mid-2023 aerodynamic overhaul turned them from backmarkers into 2024 champions, breaking a 26-year title drought. These shifts not only redefine the dynamics among top teams but also highlight the unique challenges midfield teams face when trying to keep up.

Midfield Consistency vs. Top Team Dominance

While top teams focus on winning championships and pushing engineering limits, midfield teams prioritize maximizing points for their budgets to secure vital prize money. The 2025 season demonstrated how competitive and unpredictable this fight can be: by August, only 50 points separated 5th-place Williams (70 points) from 10th-place Alpine (20 points).

Williams’ resurgence in 2025, under Team Principal James Vowles, was a standout story. Alexander Albon scored points in nine of the first 14 races, including three fifth-place finishes, helping the team climb to 5th overall. Similarly, Kick Sauber made a remarkable leap, going from just 4 points in 2024 to 51 points in 2025 through consistent execution. These midfield teams also benefit from the FIA’s sliding scale for aerodynamic testing, which gives lower-ranked teams additional resources to gradually close the gap on the frontrunners.

Predicting Championship Outcomes from Performance Trends

Forecasting championship results requires more than just keeping up with race highlights. Teams and analysts rely on advanced techniques to separate meaningful performance trends from random race-day fluctuations. By analyzing historical data and performance patterns, they can make informed predictions about championship outcomes.

Statistical Models for Performance Forecasting

Sophisticated statistical models help distinguish the car's performance from the driver's skill, offering a clearer picture of championship dynamics. Tools like Regularized Adjusted Plus Minus (RAPM) and time-decayed ridge regression with LOESS smoothing track how a constructor's contributions evolve over time. These methods consider factors like technical upgrades, regulatory changes, and development trends, providing insights that go beyond surface-level observations.

For instance, these models highlight patterns that simple point standings might miss. Data reveals that 66% of drivers who secure pole position in the season opener go on to win the Drivers' Championship. Additionally, 75% of opening pole positions are earned by cars that later win the Constructors' Championship. Over the last 30 years, no championship-winning car has finished lower than 4th in the opening race. This makes early-season performance a powerful predictor of championship success.

The financial stakes also play a role. A prize money gap of $10–15 million between 3rd and 4th place in the Constructors' standings can significantly impact a team's ability to fund future developments. This creates a cycle where better finishes lead to more resources, which in turn drive further improvements.

However, even the most advanced models can't account for every variable. External factors often introduce unpredictability into the equation.

External Factors That Affect Predictions

No matter how sophisticated, data models can struggle when external forces disrupt the competitive landscape. Major regulatory changes, such as the introduction of ground-effect aerodynamics in 2022 or the upcoming engine and chassis rules for 2026, can completely reset performance benchmarks. These shifts often level the playing field, making it harder to rely on past trends.

Human elements also add layers of unpredictability. Leadership changes, like Red Bull's decision to replace Christian Horner with Laurent Mekies in July 2025 after the team dropped to 4th place with 194 points, can alter a team's trajectory. Similarly, driver transfers can have a significant impact. For example, Williams climbed to 5th in the standings after signing Carlos Sainz, whose contributions added 16 points to their tally. These human factors, whether in leadership or driver performance, can either align with or contradict data-driven forecasts.

Budget caps have further complicated predictions. With spending limits in place, teams can no longer rely on outspending their rivals to recover performance deficits. Instead, success now hinges on operational efficiency, organizational strength, and strategic development. This shift underscores the growing importance of understanding constructor performance trends over multiple seasons, as long-term planning and resource management have become critical to staying competitive.

How Teams and Fans Use Performance Trends

Planning Development Cycles and Upgrades

In motorsport, data is king. Teams rely on massive amounts of data - 68 TB transferred in 2025 alone - to refine their cars in real time. They use tools like computational fluid dynamics (CFD), wind tunnels, and lap-time simulation software to predict how new components will perform. These predictions are then tested and validated during Friday practice sessions, with the correlation between simulation and track data serving as the ultimate benchmark.

Take McLaren's 2025 season as an example. Their relentless approach to innovation resulted in 12 Grand Prix wins and 28 podium finishes. Andrea Stella, the Team Principal, explained their mindset:

"In many aspects, we raised the bar again this year... We decided to go for development in pretty much every single part. We required some bravery in some areas, for instance, in the front suspension."

This bold strategy paid off, clinching the Constructors' Championship by Round 18 in Singapore.

But development isn't just about speed - it's also about strategy. Aero Testing Restrictions (ATR) add another layer of complexity. Teams ranked higher in the championship get less wind-tunnel time, forcing them to be more efficient with their limited resources. This creates a balancing act: teams must focus on current-season performance while knowing that success could limit their development capacity for the following year.

This meticulous, data-driven approach not only shapes team strategies but also gives fans a deeper understanding of the sport.

Data-Driven Fan Engagement

Fans, much like teams, are now harnessing data to deepen their connection to the sport. Championship simulators have become a popular tool, allowing fans to explore different race outcomes and their effects on standings and prize money. For instance, these simulators can show how a single 1-2 finish might shift championship points and influence over $10 million in prize money - directly impacting a team's aero budget for the next season.

Data also helps fans better understand race results. For example, knowing that constructors account for 64.0% of the variance in race outcomes allows fans to evaluate whether a driver’s success is due to car performance or individual skill. Additionally, tracking wind-tunnel allocations gives fans insight into which teams may face challenges the following season. Success on the track often comes with a trade-off: less testing time for future development.

The 2025 season further highlighted how tire strategies influence races. With 12 of 21 races won using a one-stop strategy, fans learned to analyze tire compound choices and degradation rates to predict race outcomes. This kind of insight transforms casual spectators into engaged analysts, enabling them to anticipate team decisions and understand the technical factors behind pit stops and upgrade schedules.

Conclusion: Performance Trends and Championship Success

Constructor performance trends go beyond simple numbers - they're the foundation for winning championships. Studies highlight that car performance often outweighs driver skill when it comes to determining race results.

The financial stakes make this even more critical. A single position in the final standings can mean a difference of $10–15 million in prize money, directly affecting a team's ability to invest in future development. For example, achieving a double podium finish can significantly boost a team's revenue, providing the resources needed for future advancements.

Teams leverage these trends to strike a balance between immediate results and long-term goals. Take McLaren's 2025 championship preparations: by manufacturing key components in-house and analyzing an enormous 68 TB of track data, they showcased how precise, data-driven strategies can lead to on-track success.

These insights not only shape team strategies but also help fans better understand race outcomes. While star drivers often grab the spotlight, consistent team performance is the real backbone of a Constructors' Championship.

FAQs

How can I tell if a result was the car or the driver?

Analyzing whether a race result stems from the car or the driver requires a closer look at performance patterns. When a driver consistently achieves top finishes under varying conditions, it often underscores their skill and adaptability. On the other hand, if a team consistently performs well across multiple tracks, it suggests the car's engineering and design are key factors. Additional elements like technical advancements, tire management strategies, and weather conditions also influence how much credit goes to the driver versus the car.

What early-season signs best predict the Constructors’ winner?

Early in the season, several factors can hint at which team might dominate the Constructors' Championship. Strong performances in the initial races are a big deal - teams that consistently secure podium finishes and rack up points set themselves apart right away.

Another critical factor is how well a team converts pole positions into race victories. Starting at the front is great, but turning that advantage into wins is what really counts. Beyond that, consistency is everything. Teams that adapt well to changing race conditions and avoid costly errors - whether it's a pit stop mishap or a driver misjudgment - tend to stay in the hunt for the title. Even small mistakes in the early stages can have a ripple effect, making every point and decision matter.

How do wind-tunnel limits change a team’s upgrade strategy?

Wind-tunnel restrictions play a crucial role in shaping a Formula 1 team's approach to upgrades. These limits cap the amount of aerodynamic testing and computational fluid dynamics (CFD) work a team can perform, forcing them to make strategic choices. Teams typically focus on introducing upgrades with the most impact early in the season, ensuring they make the best use of their limited testing opportunities.

Managing resources effectively becomes a balancing act. Teams facing stricter restrictions often lean toward cautious, step-by-step improvements, while those with more flexibility might aim for bolder aerodynamic advancements to maintain their edge on the track.